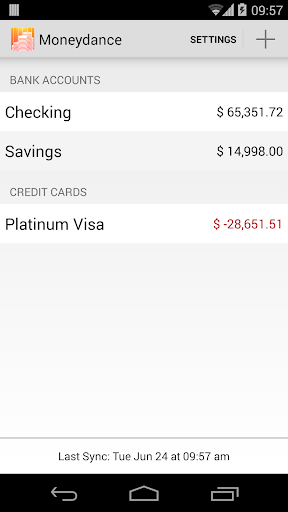

The best part is that Moneydance also includes a Graphs and Reports area that can help you analyze your spending patters by automatically generating various types of charts: account balance, asset allocation, currency history, expenses, income, income and expenses, net worth and much more. The application provides support both for deposit and payment transactions and comes with a wide collection of income and expenses categories. To help you get started, when opting for a standard account, Moneydance will generate checking and a savings bank accounts where you can record all your transactions. Depending on your decisions, Moneydance displays different elements in its main window. When you first launch the Moneydance app you must specify if you want to import data from another app or create a new document and the account type. Moneydance is a personal finances management application that provides a plethora of useful tools that will help you make educated decisions regarding your money. I do this with paychecks and automatic transfers to retirement and 529K accounts.Keeping track of one’s personal finances is not particularly easy, especially if you are using multiple checking and savings accounts, venture into different investments and you also need to function on a budget. What YNAB can do is creatively use repeating split transfers/transactions if the activity is roughly the same every month, but differing just in the amounts.

It depends on how frequently this type of activity occurs and if you truly want to see asset allocations, portfolio charts, and all the books updated in one place automatically.

True - that is a case that YNAB doesn't handle well.

#Quickbooks or moneydance for mac plus

Spammagnet wrote: An example is payroll deductions for my wife's ESPP account, with quarterly purchase of stocks, immediate sale with appropriate treatment as ordinary income plus capital gain/loss, and transfer of proceeds back to checking.

#Quickbooks or moneydance for mac full

If you set up your credit cards to pay the balance in full automatically, set up your regular bills (cell phone, utilities) to charge to your credit card and/or checking automatically, and use your debit or credit card for all retail transactions, your financial life will be almost completely automated and you can see the result easily in YNAB and PC. I used Microsoft Money waaay back for all my finances (which were much less complicated then). Triceratop wrote:I'm a very happy GnuCash user. Unfortunately then, if the portfolio tracking/analysis isn't entirely useful, then the Personal Capital platform really isn't a worthwhile solution since there are other systems/platforms out there that do a much better job with tracking spending/budgeting/forecasting/reporting/etc AND have at least some level of investment portfolio analysis. As far as I can tell, there is no way to modify the fund's asset allocation manually (nor is there a way to create additional/custom spending categories on the banking side). For instance, we have the L 2040 fund at the TSP, and Personal Capital classifies it being invested entirely as 'US Stocks,' making our overall portfolio-level asset allocation look way more aggressive than it really is. Overall, I like it for it's kind of elegant simplicity however, the portfolio tracking is only useful if you only have funds that have readily available ticker symbols.

0 kommentar(er)

0 kommentar(er)